Analysts at JPMorgan believe that any recovery from this point on will not last very long.

Additionally, the analysts anticipate that bitcoin and gold will benefit from a second Donald Trump administration.

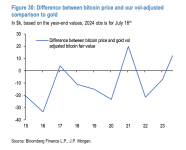

Analysts at JPMorgan believe that any rise in cryptocurrency prices after this point is more likely to be tactical, short-term, and strategic than the beginning of a long-term upward trend. They point out that bitcoin's current price of approximately $67,500 is excessive in comparison to its production cost of approximately $43,000 and its volatility-adjusted comparison to gold, which is approximately $53,000.

The distinction between bitcoin's value and JPMorgan's unpredictability changed correlation with gold "focuses to mean inversion around the zero line, consequently compelling any potential gain potential at bitcoin costs over the more extended term," JPMorgan examiners, drove by overseeing chief Nikolaos Panigirtzoglou, wrote in a report on Thursday.

The investigators emphasized that crypto bounce back are normal from August onwards as liquidations decline after July. They mentioned that the German government selling seized bitcoins and liquidations by Gemini and Mt. Gox creditors have weakened bitcoin futures recently. According to the analysts, these sales will probably stop after July, and they anticipate a rebound in bitcoin futures starting in August, which is in line with recent increases in gold futures.

The analysts stated, "We believe that momentum traders such as CTAs (commodity trading advisors) have played a significant role in the gold futures impulse." In July, the gold momentum signal spiked toward April's previous overbought territory.

JPMorgan on a possible second Trump administration Gold and Bitcoin BTC +0.22% are expected to benefit from a possible second Trump administration, according to JPMorgan analysts. According to the analysts, some investors believe that Trump is more supportive of crypto companies and regulations than the current Biden administration. They added that emerging market central banks, particularly China's, could increase their gold diversification as a result of Trump's potential trade policies.