In the realm of carding, 3D Secure has emerged as a significant obstacle for numerous carders. As websites enhance their security measures, those who seek to generate profits from carding must discover innovative methods to do so. The antiquated techniques are no longer effective, and novel concepts are necessary to keep pace with more robust anti-fraud mechanisms.

What are OTP Bots?

OTP bots are ingenious software engineered to circumvent 3DS and OTP requests. These bots employ cunning tactics to persuade individuals to divulge their OTPs through voice calls. The bots operate by combining technology with an understanding of human psychology and behaviour. They utilise sophisticated methods to exploit human habits and vulnerabilities. These bots initiate contact with individuals through automated phone calls, all of which are meticulously crafted to appear as if they originate from official sources.

One prevalent strategy these bots employ is to instil a sense of urgency. For instance, a bot may initiate a call asserting that there is a security issue with the individual's account. It will state that the person must act promptly to prevent someone from misappropriating their funds. The bot then guides the person through a series of steps, eventually requesting the OTP under the pretext of verifying their identity.

Another ruse these bots employ is to masquerade as if they are confirming a transaction. The bot will contact the person, claiming to be from their bank's fraud department. It will ask the person to confirm a recent purchase by providing the OTP they just received. This tactic exploits people's natural inclination to cooperate with their bank and safeguard their accounts from fraudulent activities.

These OTP bots utilise advanced voice technology that converts text into speech. These calls are designed to emulate the automated systems that banks typically employ, rendering them more authentic and convincing to the cardholder.

When an individual succumbs to these deceptions and divulges their OTP during the call, the bot swiftly transmits this information back to you. With this confidential code, you can then execute transactions, impersonating the genuine account holder, thereby bypassing 3DS and OTP safeguards.

How do OTP Bots Operate?

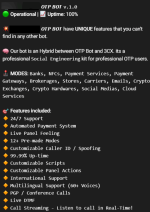

Utilising OTP bots effectively necessitates meticulous planning and attention to detail. The crux of the matter is discovering a dependable and efficient bot. Whilst numerous options are available online, prudence is paramount. Seek out bots with favourable reviews, proven success rates, and dependable support. Take into account factors such as the duration the bot has been available, the frequency of updates, and its compatibility with various financial institutions.

Numerous high-quality bots are equipped with pre-designed scripts tailored for specific banks. These scripts are crafted to emulate the automated systems employed by banks for telephonic communication, thereby enhancing their efficacy in deceiving cardholders. The most sophisticated scripts can adapt based on predefined responses, mimicking the progression of a standard automated bank call.

To employ the bot, first attempt to make a purchase on a website that utilises 3DS security or necessitates an OTP. Suitable options include secure online retailers or services such as Apple Pay. Initiate the purchase of an item (or linking your card) and await the website's prompt for the OTP. This is the opportune moment to activate the bot.

When the OTP prompt materialises, employ the bot to establish contact with the cardholder via a telephone call. The bot will initiate the call, masquerading as an automated system from the bank or a security service. The bot endeavours to instil a sense of urgency in the cardholder, compelling them to act swiftly without arousing suspicion. Whilst the bot engages with the cardholder, it is imperative to observe attentively. High-calibre bots provide real-time updates on the progress of the interaction. This information facilitates the refinement of your technique and deepens your understanding of how cardholders typically respond to these automated calls.

The pivotal moment arises when the cardholder divulges the OTP during the call. Sophisticated bots will promptly relay this information to you through the designated channel. Swift action is required to utilise the OTP and conclude the transaction before it expires or the cardholder realises something is amiss.

Thanks for watching and liks.

What are OTP Bots?

OTP bots are ingenious software engineered to circumvent 3DS and OTP requests. These bots employ cunning tactics to persuade individuals to divulge their OTPs through voice calls. The bots operate by combining technology with an understanding of human psychology and behaviour. They utilise sophisticated methods to exploit human habits and vulnerabilities. These bots initiate contact with individuals through automated phone calls, all of which are meticulously crafted to appear as if they originate from official sources.

One prevalent strategy these bots employ is to instil a sense of urgency. For instance, a bot may initiate a call asserting that there is a security issue with the individual's account. It will state that the person must act promptly to prevent someone from misappropriating their funds. The bot then guides the person through a series of steps, eventually requesting the OTP under the pretext of verifying their identity.

Another ruse these bots employ is to masquerade as if they are confirming a transaction. The bot will contact the person, claiming to be from their bank's fraud department. It will ask the person to confirm a recent purchase by providing the OTP they just received. This tactic exploits people's natural inclination to cooperate with their bank and safeguard their accounts from fraudulent activities.

These OTP bots utilise advanced voice technology that converts text into speech. These calls are designed to emulate the automated systems that banks typically employ, rendering them more authentic and convincing to the cardholder.

When an individual succumbs to these deceptions and divulges their OTP during the call, the bot swiftly transmits this information back to you. With this confidential code, you can then execute transactions, impersonating the genuine account holder, thereby bypassing 3DS and OTP safeguards.

How do OTP Bots Operate?

Utilising OTP bots effectively necessitates meticulous planning and attention to detail. The crux of the matter is discovering a dependable and efficient bot. Whilst numerous options are available online, prudence is paramount. Seek out bots with favourable reviews, proven success rates, and dependable support. Take into account factors such as the duration the bot has been available, the frequency of updates, and its compatibility with various financial institutions.

Numerous high-quality bots are equipped with pre-designed scripts tailored for specific banks. These scripts are crafted to emulate the automated systems employed by banks for telephonic communication, thereby enhancing their efficacy in deceiving cardholders. The most sophisticated scripts can adapt based on predefined responses, mimicking the progression of a standard automated bank call.

To employ the bot, first attempt to make a purchase on a website that utilises 3DS security or necessitates an OTP. Suitable options include secure online retailers or services such as Apple Pay. Initiate the purchase of an item (or linking your card) and await the website's prompt for the OTP. This is the opportune moment to activate the bot.

When the OTP prompt materialises, employ the bot to establish contact with the cardholder via a telephone call. The bot will initiate the call, masquerading as an automated system from the bank or a security service. The bot endeavours to instil a sense of urgency in the cardholder, compelling them to act swiftly without arousing suspicion. Whilst the bot engages with the cardholder, it is imperative to observe attentively. High-calibre bots provide real-time updates on the progress of the interaction. This information facilitates the refinement of your technique and deepens your understanding of how cardholders typically respond to these automated calls.

The pivotal moment arises when the cardholder divulges the OTP during the call. Sophisticated bots will promptly relay this information to you through the designated channel. Swift action is required to utilise the OTP and conclude the transaction before it expires or the cardholder realises something is amiss.

Thanks for watching and liks.