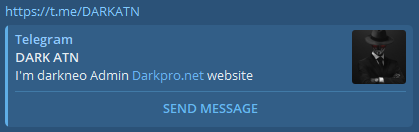

↤ 𝔻𝕒𝕣𝕜 ℕ𝕖𝕠 ↦

Admin, Carder, Hacker, Deepweb Seller

Staff member

Administrative

Moderating

Staff Member

Premium User

Forum Elite

Introduction: The Quantum Leap in Finance

Imagine a computer so powerful that it can solve complex financial problems in seconds—problems that would take traditional supercomputers thousands of years. That’s the promise of quantum computing, a revolutionary technology set to transform financial services.From risk modeling and fraud detection to high-frequency trading and portfolio optimization, quantum computing is reshaping how banks, hedge funds, and fintech companies operate. But how exactly does it work? And why should financial institutions care?

In this article, we’ll explore:

- What quantum computing is and how it differs from classical computing

- Real-world applications in finance

- Challenges and risks of adoption

- Expert predictions on the future of quantum finance

What Is Quantum Computing? (And Why Is It a Game-Changer?)

Classical vs. Quantum Computing: The Key Differences

Traditional computers use bits (0s and 1s) to process information. Quantum computers, however, use qubits (quantum bits), which can exist in multiple states simultaneously thanks to two key principles:- Superposition – A qubit can be 0, 1, or both at the same time.

- Entanglement – Qubits can be linked, meaning the state of one instantly influences another, no matter the distance.

Why Financial Institutions Are Betting Big on Quantum

Banks like JPMorgan Chase, Goldman Sachs, and Barclays are already investing heavily in quantum research. According to a 2023 McKinsey report, quantum computing could add $700 billion in value to the finance sector by 2035.Key areas where quantum computing excels:

✔ Optimization problems (e.g., portfolio management)

✔ Cryptography & cybersecurity

✔ Monte Carlo simulations (risk assessment)

✔ Machine learning & AI-driven predictions

How Quantum Computing Is Revolutionizing Financial Services

1. Fraud Detection & Cybersecurity

LSI Keywords: quantum encryption, financial fraud prevention, secure transactionsCyberattacks cost the global economy $8 trillion annually (Cybersecurity Ventures, 2023). Quantum computers can:

- Break traditional encryption (posing a risk)

- Create unhackable quantum encryption (quantum key distribution)

Mastercard is developing quantum-resistant algorithms to protect payment systems from future threats.

2. High-Frequency Trading (HFT) & Algorithmic Trading

LSI Keywords: quantum trading algorithms, stock market predictions, low-latency tradingHFT firms rely on ultra-fast decision-making. Quantum computing can:

- Analyze millions of market scenarios in real-time

- Optimize trading strategies with near-perfect accuracy

Goldman Sachs partnered with QC Ware to explore quantum-powered trading models, potentially gaining a millisecond edge over competitors.

3. Risk Management & Monte Carlo Simulations

LSI Keywords: quantum risk analysis, financial forecasting, probabilistic modelingBanks spend billions on risk modeling. Quantum computers can:

- Run 10,000x faster Monte Carlo simulations

- Predict market crashes and credit risks more accurately

"Quantum computing will allow us to model financial systems in ways we’ve never imagined." – Dr. William Zeng, Head of Quantum Research at Goldman Sachs

4. Portfolio Optimization & Asset Management

LSI Keywords: quantum asset allocation, investment strategies, hedge fund optimizationFinding the optimal investment mix is computationally intense. Quantum algorithms like QAOA (Quantum Approximate Optimization Algorithm) can:

- Evaluate trillions of portfolio combinations in minutes

- Maximize returns while minimizing risk

JPMorgan is testing quantum-powered portfolio optimization with IBM’s quantum processors.

Challenges & Risks of Quantum Computing in Finance

1. Technical Barriers

- Qubit instability (quantum decoherence)

- Error rates in calculations

- High costs of development

2. Security Threats

- Quantum computers could crack RSA encryption, threatening blockchain and banking security.

- Solution: Post-quantum cryptography (PQC) is being developed by NIST.

3. Regulatory & Ethical Concerns

- Who gets access? (Could widen the gap between big banks and smaller firms)

- Algorithmic bias risks in AI-driven quantum models

The Future of Quantum Finance: Expert Predictions

Short-Term (2024-2030)

- Hybrid quantum-classical systems will dominate.

- Quantum cloud services (like AWS Braket, IBM Quantum) will grow.

Long-Term (2030 & Beyond)

- Fully fault-tolerant quantum computers could disrupt global markets.

- Central banks may adopt quantum-secure digital currencies.

"By 2035, quantum computing will be as essential to finance as AI is today." – Dr. Michio Kaku, Theoretical Physicist

Conclusion: Is Your Financial Firm Ready for the Quantum Era?

Quantum computing isn’t just science fiction—it’s happening now. Financial institutions that adopt early will gain a massive competitive edge, while those that wait risk falling behind.Key Takeaways:

Quantum computing solves complex financial problems exponentially faster.

Quantum computing solves complex financial problems exponentially faster. Applications include fraud detection, trading, risk modeling, and asset management.

Applications include fraud detection, trading, risk modeling, and asset management. Challenges remain, but post-quantum cryptography is evolving.

Challenges remain, but post-quantum cryptography is evolving. The future of finance is hybrid quantum-classical systems.

The future of finance is hybrid quantum-classical systems.Is your organization prepared for the quantum revolution?

SEO & SEM Optimization Summary

Primary Keywords:- Quantum computing in finance

- Quantum financial services

- Quantum banking solutions

- Quantum risk analysis

- Post-quantum cryptography

- Quantum trading algorithms

- Quantum portfolio optimization

- Quantum encryption finance

- Q: How is quantum computing used in finance?

A: Quantum computing enhances fraud detection, high-frequency trading, risk modeling, and portfolio optimization by processing data exponentially faster than classical computers.

- Expert quotes (Goldman Sachs, JPMorgan)

- Real-world case studies (Mastercard, QC Ware)

- Research-backed data (McKinsey, Cybersecurity Ventures)