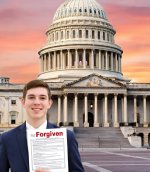

Loan Forgiveness Student Loans 2025 – What You Need to Know Now

Loan Forgiveness Student Loans 2025 – What You Need to Know Now

Hey forum fam,

There’s been a LOT of talk lately about student loan forgiveness — and if you’ve got debt hanging over your head, this might be the most important update you’ll read all year.

Here’s everything you need to know about the current state of loan forgiveness for student loans in 2025, broken down in simple, real-world terms.

What's Happening Right Now?

What's Happening Right Now?As of mid-2025, the U.S. government has rolled out several new initiatives to ease the burden of student loan debt. Here's a quick overview:

Income-Driven Repayment (IDR) forgiveness after 10 or 20 years

Income-Driven Repayment (IDR) forgiveness after 10 or 20 years  Public Service Loan Forgiveness (PSLF) expanded to more job categories

Public Service Loan Forgiveness (PSLF) expanded to more job categories  One-time forgiveness adjustments for older loans

One-time forgiveness adjustments for older loans  $10,000–$20,000 federal forgiveness plans under review (pending Supreme Court decision)

$10,000–$20,000 federal forgiveness plans under review (pending Supreme Court decision) Who Qualifies?

Who Qualifies?The short answer? It depends. Here's a quick breakdown:

PSLF: Work in public service, nonprofit, education, or healthcare? You may qualify.

PSLF: Work in public service, nonprofit, education, or healthcare? You may qualify.  IDR: Been repaying for 10+ years on a qualifying plan? Forgiveness might be automatic.

IDR: Been repaying for 10+ years on a qualifying plan? Forgiveness might be automatic.  One-time Adjustments: If you had deferments, forbearance, or in-school pauses — you might still get credit!

One-time Adjustments: If you had deferments, forbearance, or in-school pauses — you might still get credit! Key Dates to Watch

Key Dates to Watch July 2025: Income-driven plan recertification deadline

July 2025: Income-driven plan recertification deadline  October 2025: PSLF limited waiver deadline (check if extended)

October 2025: PSLF limited waiver deadline (check if extended)  Early 2026: Potential rollout of new automatic forgiveness system

Early 2026: Potential rollout of new automatic forgiveness system What You Should Do Now

What You Should Do Now1. Log in to StudentAid.gov and review your loan status.

2. Use the Loan Simulator to check forgiveness eligibility.

3. Consider switching to a qualifying repayment plan.

4. Save copies of ALL communication with your servicer.

Community Talk Time

Community Talk TimeWhat do YOU think about the new student loan forgiveness plans?

Do you qualify? Are you skeptical? Already had debt wiped out?

Let us know below — your voice matters!