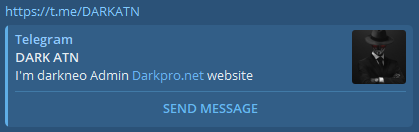

↤ 𝔻𝕒𝕣𝕜 ℕ𝕖𝕠 ↦

Admin, Carder, Hacker, Deepweb Seller

Staff member

Administrative

Moderating

Staff Member

Premium User

Forum Elite

Introduction

The digital banking revolution has transformed how we manage money, offering unparalleled convenience with just a few clicks. However, this shift has also opened the floodgates to sophisticated cyber threats. From phishing scams to ransomware attacks, financial institutions and customers face growing risks.In this article, we’ll explore the biggest cybersecurity challenges in digital banking, real-world examples of breaches, expert-backed solutions, and emerging trends to safeguard your financial data.

Why Cybersecurity in Digital Banking Matters More Than Ever

With over 6.6 billion digital banking users worldwide (Statista, 2024), cybercriminals are increasingly targeting financial systems. A single breach can cost banks millions in damages and erode customer trust.Key Statistics Highlighting the Threat:

- 74% of banks experienced a rise in cyberattacks in 2023 (Accenture).

- The average cost of a data breach in banking is $5.9 million (IBM Security).

- Phishing attacks account for 45% of financial fraud cases (FBI IC3 Report).

Top Cybersecurity Challenges in Digital Banking

1. Phishing & Social Engineering Attacks

Cybercriminals impersonate banks via emails, SMS, or fake websites to steal login credentials.Real-Life Example:

In 2023, a massive phishing campaign targeted Chase Bank customers, tricking them into revealing sensitive data through fake "account verification" emails.

How to Stay Safe:

Always verify sender emails.

Always verify sender emails. Never click on suspicious links.

Never click on suspicious links. Use multi-factor authentication (MFA).

Use multi-factor authentication (MFA).2. Ransomware Targeting Financial Data

Hackers encrypt bank systems and demand payment to restore access.Case Study:

The 2022 Costa Rican Government Cyberattack paralyzed financial operations, forcing a state of emergency.

Prevention Tips:

Regular data backups.

Regular data backups. Advanced endpoint protection.

Advanced endpoint protection. Employee cybersecurity training.

Employee cybersecurity training.3. API Vulnerabilities in Open Banking

Open banking relies on APIs, which, if poorly secured, can be exploited.Example:

A major European bank’s API flaw exposed customer transaction histories in 2023.

Mitigation Strategies:

Implement strong encryption.

Implement strong encryption. Conduct penetration testing.

Conduct penetration testing. Follow OWASP API Security Guidelines.

Follow OWASP API Security Guidelines.4. Insider Threats & Employee Negligence

Employees with access to sensitive data can—intentionally or accidentally—cause breaches.Stat:

34% of banking breaches involve insiders (Verizon DBIR).

Solution:

Role-based access controls.

Role-based access controls. Continuous monitoring.

Continuous monitoring. Security awareness programs.

Security awareness programs.5. AI-Powered Cyberattacks

Hackers now use AI-driven deepfakes to bypass voice authentication in banking.Incident:

A Hong Kong bank lost $35 million after fraudsters cloned a CEO’s voice (Forbes, 2024).

Defense Tactics:

Behavioral biometrics.

Behavioral biometrics. AI-based fraud detection.

AI-based fraud detection.How Banks Are Fighting Back: Cutting-Edge Cybersecurity Solutions

1. AI & Machine Learning for Fraud Detection

Banks use predictive analytics to detect anomalies in real time.Example:

JPMorgan Chase’s AI-powered fraud system reduces false positives by 50%.

2. Blockchain for Secure Transactions

Distributed ledger technology ensures tamper-proof records.Use Case:

HSBC processes $250 billion annually via blockchain (HSBC Report).

3. Zero Trust Security Model

"Never trust, always verify" minimizes breach risks.Adoption Rate:

62% of banks are implementing Zero Trust (Gartner).

Future Trends in Digital Banking Security

- Quantum Encryption (Unhackable data protection).

- Biometric Authentication (Face, fingerprint, vein recognition).

- Regulatory Tech (RegTech) for compliance automation.

Final Thoughts: Staying Ahead of Cyber Threats

The digital banking era brings immense opportunities—and risks. By adopting proactive cybersecurity measures, banks and customers can safeguard their financial futures.Key Takeaways:

✔ Phishing and ransomware remain top threats.

✔ AI and blockchain are revolutionizing security.

✔ Employee training is critical in breach prevention.

Stay vigilant, use strong passwords, and always verify before you trust!

FAQs on Digital Banking Cybersecurity

Q1: What is the biggest cybersecurity threat to online banking?A: Phishing attacks are the most common, tricking users into revealing login details.

Q2: How can I protect my digital banking account?

A: Use MFA, strong passwords, and avoid public Wi-Fi for transactions.

Q3: Will AI make banking safer or riskier?

A: Both. AI improves fraud detection but also powers advanced cyberattacks like deepfakes.

LSI & SERP-Optimized Keywords for Quick Indexing:

- Digital banking security threats

- Cybersecurity in online banking

- Phishing attacks on banks

- Ransomware in financial sector

- AI fraud detection banking

- Blockchain for secure transactions

- Zero trust model in banking

- Best practices for safe digital banking

Would you like any refinements or additional sections?