↤ 𝔻𝕒𝕣𝕜 ℕ𝕖𝕠 ↦

Admin, Carder, Hacker, Deepweb Seller

Staff member

Administrative

Moderating

Staff Member

Premium User

Forum Elite

Financial backers have rushed to the late sent-off bitcoin trade exchanged store (ETF), which plans to benefit from the cryptographic money's falling cost — the vehicle is currently the second-biggest bitcoin-centered ETF in the U.S. market, second just to a couple of exchanging days.

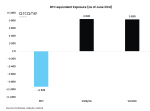

Examiners at Obscure Exploration noticed that the ProShares Short Bitcoin Technique (BITI) ETF acquired what might be compared to 544.2 BTC, or $11 million, making it the second-biggest trade exchanged Bitcoin reserve recorded on Vetle Lunde.

The asset is intended to give the contrary exhibition of Bitcoin, truly intending that assuming the cost of BTC falls by 1% (before the executive's charges and costs), financial backers in the asset will acquire 1% of their speculation benefits by holding BTC subsidiaries. It began exchanging on the New York Stock Trade on Tuesday.

Investigators disregarded BITI's unfortunate first day of the season.

Nonetheless, Lunde said BITI had solid inflows on Wednesday and Thursday, with resources under administration comparable to 929 BTC, destroying bitcoin prospects ETFs from reserve suppliers Valkyrie and VanEck.

The biggest Bitcoin ETF recorded in the U.S. All is the ProShares Fates Based Bitcoin ETF (BITO), which has resources under administration comparable to 31,000 Bitcoins, or $651 million at current costs, far dominating its rivals.

The solid exhibition of BTI mirrors the delicate condition of the digital money market as dealers weigh whether it is a great chance to purchase BTC and how much further its cost might fall.

"At the present time, the truth of a downturn gives off an impression of being driving the market," said Craig Erlam, senior market investigator at Oanda. "I don't see this working on sooner rather than later, which makes the ongoing help for Bitcoin around $20,000 looks delicate."

On Twitter, a few banners have called the send-off of a short bitcoin store a potential base sign, an illogical move that isn't without a legitimate point of reference: ProShares declared last October that it would send off a bitcoin fates ETF, and soon after the BTC moved to an unequaled high of almost $69,000 in November.

John Freyermuth, an examination expert at Mystery Protections, said evaluating the progress of the product was too soon. "The most gamble cognizant players are probably not going to investigate these prospects-based ETFs, not to mention those with converse openness to fates lists," he said.

Numerous crypto industry chiefs and merchants have for quite some time been enthusiastic for controllers to support a spot bitcoin ETF that would give value financial backers the greatest openness to crypto resources without really claiming any resources, as they accept the construction Better than fates-based reserves the SEC has endorsed up until this point.

"It's important that another subsidiary-based item was sent off before the spot item," Freyermuth said.