↤ 𝔻𝕒𝕣𝕜 ℕ𝕖𝕠 ↦

Admin, Carder, Hacker, Deepweb Seller

Staff member

Administrative

Moderating

Staff Member

Premium User

Forum Elite

| Key Experiences: It was one more bullish meeting for the crypto market on Friday, with Solana (SOL) and Wave (XRP) driving the main ten. |

The crypto majors followed the US value markets, with further developed market risk opinion conveying the NASDAQ a 3.34% increase.

In the wake of including $48 billion Thursday, the complete crypto market cap rose a further $25 billion.

It was one more bullish meeting for the crypto market on Friday. Bitcoin (BTC) and the more extensive market followed the NASDAQ 100 to convey a second sequential day-to-day rise.

Sliding item costs facilitated tension on more hazardous resources inside the week, with WTI rough falling back from $110 levels. The Bloomberg Ware Record (BCI) finished the week with a 4.28% misfortune, mirroring an expansive based decrease in product costs.

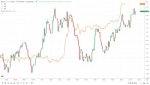

The week-after-week outline underneath mirrors the opposite relationship between WTI and the NASDAQ 100 and bitcoin.

A supported pullback in item costs could influence the Federal Reserve's loan fee direction and backing less secure resources.

The All-out Crypto Market Cap is on Way to dealing with $1,000bn

Following a $48 billion ascent on Thursday, the all-out crypto market cap is setting out toward a $27 billion increment on Friday. A bullish Friday meeting saw the market cap hit a day high of $946 billion preceding moving back.

While headwinds remain, financial backers set to the side opinion toward expansion, national bank money-related strategy, and the monetary standpoint.

Taking care of Seat Powell's declaration and the Federal Reserve's obligation to carry expansion to focus at any expense will keep on reverberating. A supported descending pattern in raw petroleum costs would facilitate some headwind pressure.

Two bullish meetings leave the absolute market cap in the sure area for the week while somewhere near more than $350 billion for June. Right now sitting at $937 billion, financial backers will need to see the all-out market cap head towards the $1.5 trillion imprints to move opinion.

Friday's bullish opinion was apparent across the crypto market top ten.